Why It Matters Now for Compliance Teams

The EU is entering a new phase in its fight against financial crime. With the upcoming launch of the Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), compliance professionals across Europe need to prepare for a transformed AML/CFT regulatory landscape.

What Is AMLA?

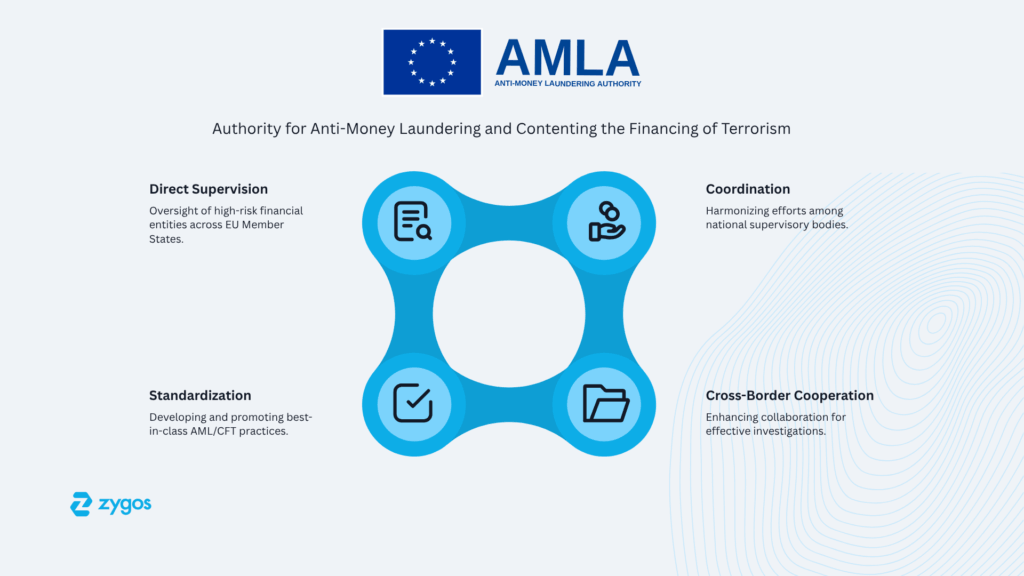

AMLA is the first centralized EU authority dedicated exclusively to tackling money laundering and terrorist financing. Set to be fully operational by 2026 and based in Frankfurt, the AMLA will:

- Directly supervise high-risk financial entities across Member States

- Coordinate national supervisory bodies to ensure unified enforcement

- Harmonize AML/CFT practices and promote best-in-class standards

- Enhance cross-border cooperation for more effective investigations

It’s a bold step toward a more integrated and robust AML framework at the EU level.

What Will AMLA Actually Do?

AMLA is designed to be much more than a symbolic institution. Its core functions will include:

- Risk-based direct supervision of select credit and financial institutions

- Oversight and support to Financial Intelligence Units (FIUs)

- Development of common EU methodologies and technical guidance

- Creation of a single rulebook for AML/CFT compliance

- Acting as a hub for data-sharing, alerts, and coordination across borders

What Does This Mean for Compliance Departments?

The creation of AMLA signals a step-change in expectations for compliance teams across Europe. While it aims to bring consistency across Member States, it will also raise the bar significantly in terms of regulatory scrutiny and operational readiness.

Compliance officers should be preparing for:

- Stricter and more centralized oversight of AML frameworks, especially for institutions operating across borders

- Greater transparency obligations, with more rigorous documentation and real-time reporting expectations

- Tighter internal alignment between legal, compliance, and risk departments to respond to supervisory demands

- A shift toward data-driven AML processes, with standardization in transaction monitoring, client risk scoring, and auditability

This is especially relevant for banks, payment firms, fintechs, crypto exchanges, and any financial entity that operates in multiple jurisdictions or handles complex risk profiles.

How Can Legal Firms Prepare for AMLA?

Legal and advisory firms supporting regulated entities must also gear up for AMLA’s arrival, especially those offering compliance consultancy, onboarding, or KYC services, or outsourced MLRO roles.

To remain competitive and compliant, legal teams should consider:

- Reviewing and realigning AML advisory workflows with the upcoming EU-wide requirements

- Offering proactive compliance risk assessments for clients likely to fall under AMLA’s direct supervision

- Investing in case management and digital KYC tools to streamline AML onboarding and review processes

- Building collaboration bridges with in-house compliance teams, particularly in interpreting evolving AMLA technical guidance

Zygos offers key tools to support this shift, including:

- Client screening and KYC workflows

- Entity and document management for regulated structures

- Time, billing, and financial tracking for AML-related matters

- Litigation and project management tools for compliance-heavy caseloads

With AMLA set to increase complexity, platforms like Zygos can help legal teams stay efficient, compliant, and audit-ready.

Why AMLA Is Top of Mind for Compliance Professionals Right Now

Beyond its regulatory role, AMLA represents a strategic shift in the EU’s response to major scandals and systemic vulnerabilities (e.g., Danske Bank, Wirecard). It marks the start of a more assertive EU AML policy – one with direct enforcement power.

For any business subject to AML/CFT regulation, now is the time to align compliance strategy, resources, and governance with what AMLA is poised to enforce.